Corporate Governance

Chairman’s statement on corporate governance

All members of the Board believe strongly in the value and importance of good corporate governance and in our accountability to all the Company’s stakeholders, including shareholders, staff, customers and suppliers. In the statement below, we explain our approach to governance, and how the Board and its committees operate.

The corporate governance framework which the Company operates, including Board leadership and effectiveness, Board remuneration, and internal control, is based upon practices which the Board believes are proportional to the size, risks, complexity and operations of the business and is reflective of the Group’s values. The Board adopts the Quoted Companies Alliance’s (‘QCA’) Corporate Governance Code for small and mid-size quoted companies.

The QCA Code is constructed around ten broad principles and a set of disclosures. The QCA has stated what it considers to be appropriate arrangements for growing companies and asks companies to provide an explanation about how they are meeting the principles through the prescribed disclosures.

| Delivering growth | |

| 1 – Establishing a strategy and business model which promote long-term value for shareholders | |

| 2 – Seek to understand and meet shareholder needs and expectations | Shareholder communications and engagement |

|

3 – Consider wider stakeholder and social responsibilities and their implications for long-term success |

Shareholder communications and engagement |

|

4 – Embed effective risk management, considering both opportunities and threats, throughout the organisation |

See this section and the ‘Principal Risks and Uncertainties’ in the 2024 Report and Accounts |

| Maintain a dynamic management framework | |

| 5 – Maintain the board as a well-functioning, balanced team led by the Chairman | Board structure, skills and compliance |

| 6 – Ensure that between them the Directors have the necessary up-to-date experience, skills and capabilities |

See this section and the Director profiles |

|

7 – Evaluate board performance based on clear and relevant objectives, seeking continuous improvement |

Board evaluation and performance |

|

8 – Promote a corporate culture that is based on ethical values and behaviours |

Corporate culture, environmental and social responsibility |

|

9 – Maintain governance structures and processes that are fit for purpose and support good decision-making by the Board |

Board structure, skills and compliance |

|

Build trust |

|

|

10 – Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders |

Shareholder communications and engagement |

The Board considers that it does not depart from any of the principles of the QCA Code.

Establishing a strategy and business model which promotes long-term value for shareholders

Our Mission

Our Mission is to improve patients’ lives and grow shareholder value by developing novel cancer therapies and powerful diagnostics using our proprietary Affimer® and pre|CISION® platforms.

Investment opportunity

- Avacta Group is strategically transitioning into a pure-play oncology therapeutics company by the ongoing divestment of its diagnostics division. This move allows the company to concentrate resources on its proprietary pre|CISION® platform, aiming to revolutionize cancer treatment through targeted peptide drug conjugates (PDCs)

- In March 2025, Avacta sold its UK-based diagnostics unit, Launch Diagnostics Holdings Limited, for £12.9 million (net £10.6 million) in cash to Duomed Belgium NV. This sale is a significant step toward Avacta’s goal of becoming a dedicated biotechnology company. Coris BioConcept currently being held for sale pending divestment process. ALS-Dx unit closed during the year reducing operating costs going forward.

Technology platforms

Avacta has two proprietary platform technologies – the Affimer® and pre|CISION® platforms – which are being used to deliver a robust portfolio of products that address multi-billion dollar markets.

- The pre|CISION® platform is a highly specific substrate for fibroblast activation protein (FAP) which is highly upregulated in most solid tumours compared with healthy tissues. The pre|CISION® platform harnesses this tumour-specific protease to activate pre|CISION peptide drug conjugates and pre|CISION® antibody drug conjugates in the tumour microenvironment, reducing systemic exposure and toxicity, allowing dosing to be optimised to deliver the best outcomes for patients.

- Affimer® molecules are engineered alternatives to antibodies that have significant competitive advantages including size, stability, versatility, rapid development and ease of production.

Therapeutics Division

- Avacta Therapeutics’ strategy is to develop and ultimately commercialize a broad portfolio of product candidates based on the ability of our pre|CISION® technology to deliver potent warheads to tumors. In principle, if applied to all patients whose tumors overexpress FAP, our approach could lead to treatments for hundreds of thousands of Our strategy to achieve this goal is as follows:

- Continue to develop AVA6000 for the treatment of breast cancer, head and neck cancers and other tumors sensitive to Interim data from our ongoing Phase 1 trial indicates that AVA6000 delivers high concentrations of released doxorubicin directly to tumors in human subjects resulting in fewer toxicities than reported in the literature for conventional doxorubicin administration. We have observed clinically meaningful antitumor activity in the Phase 1a portion of this trial. To confirm this activity, we opened the indication-specific dose expansion cohorts to screening in December 2024 and will begin dosing patients early in 2025.

- Advance AVA6103 into and through clinical We have demonstrated the ability of our pre|CISION® technology to be applied to other warheads through the creation of AVA6103, an exatecan derivative. We intend to select a product candidate in the second half of 2024 and subsequently file an IND and initiate a Phase 1 trial of AVA6103 in the first half of 2026.

- Advance AVA7100 into and through clinical development. We believe AVA7100, utilizing our Affimer® proteins, will have the potential to impart tumor-antigen-specific targeting of pre|CISION® drug conjugates with improved pharmacokinetics that will optimize targeting of tumor types that have lower expression of FAP. We expect to nominate a FAP-targeted Affimer® pre|CISION® product candidate in our AVA7100 program in the second half of 2025 and to advance this program into IND-enabling studies.

- Establish product-based partnerships on pre|CISION® product candidates. We believe that the broad applicability of our pre|CISION® technology can drive the creation of a number of product candidates. We may seek to accelerate the development of some of these product candidates with corporate partners with clinical expertise in certain therapeutic areas or geographies.

- Explore additional technology-based collaborations surrounding our pre|CISION® and Affimer® platforms. We believe that the broad potential of these technology platforms may serve as the basis for future partnerships outside of our core area of focus. For example, we have previously licensed our pre|CISION® technology to POINT Biopharma Inc., or POINT, for the development of radiopharmaceutical product candidates; and we have partnerships with both Pharmaceutical Co. Ltd., or Daewoong, and LG Chem Life Sciences, or LG Chem, focused on generation of therapeutics based on our Affimer® technology.

Diagnostics Division

- The Group’s strategy is to focus its cash resources on growing the Therapeutics Division which the Board believes is now the main value driver of the Group. Whilst the Diagnostics Division is expected to be cash generative in the near future, it is strategically important for the Group to simplify its structure in order to attract specialist healthcare investors with the ability to support the growing pre-clinical and clinical pipeline of pre|CISION® and Affimer® therapeutics and it will do so in a manner which maximises value for its shareholders..

- The Group’s internal diagnostics development group (ALS-Dx) ceased operations during the year, reducing significant workforce and facility expenses. Launch Diagnostics divestment completed March 2025, Coris divestment currently ongoing.

Board structure, skills and compliance

The Board has a collective responsibility and legal obligation to promote the interests of the Company and to define the corporate governance arrangements. At 31 December 2024, the Board comprised five Non-executive Directors and one Executive Directors. The profiles of the Directors are set out on pages 37 to 39.

The division of responsibilities between the Chairman and the Chief Executive Officer is clearly defined. The Chairman’s primary responsibility is ensuring the effectiveness of the Board and setting its agenda. The Chairman is not involved in the day-to-day business of the Group. The Chief Executive has direct charge of the Group on a day-to-day basis and is accountable to the Board for the financial and operational performance of the Group.

The Chairman, Shaun Chilton, was appointed as a Non-Executive director in June 2023 and appointed as Chairman in June 2024. Prior to his appointment to the Board, he was not involved with any part of the Avacta Group and has been considered independent since his appointment. Shaun has held a number of senior and executive commercial positions over more than 30 years in companies in pharmaceutical and pharmaceutical services industries. Shaun’s time commitment is one to two days per month.

The Chief Executive Officer, Dr Christina Coughlin was appointed as a Non-executive Director in March 2022. Prior to her appointment to the Board, she was not involved with any part of the Avacta Group and was considered independent up to July 2023. In late July 2023 Christina undertook an additional consulting role to assist the Therapeutics Division with the clinical trials of its lead asset, AVA6000. This consulting role continued through to the end of January 2024, at which point Christina joined Avacta full time to become an Executive Director and Head of Research and Development. In late April 2024 Chirstina was named Chief Executive Officer. Christina has an extensive background in the pharmaceutical and biotechnology fields, with a broad background of drug development from pre-IND to filing experience in global companies. Christina’s time commitment from February 2024 is full time.

Paul Fry was appointed as a Non-executive Director in February 2020. Prior to his appointment to the Board, he was not involved with any part of the Avacta Group and has been considered independent since his appointment. Paul has an extensive financial background within the life sciences sector and has been Chairman of the Audit Committee since his appointment to the Board. Paul’s time commitment is one to two days per month.

Dr Mark Goldberg was appointed as a Non-executive Director in August 2021. Prior to his appointment to the Board, he was not involved with any part of the Avacta Group and has been considered independent since his appointment. Mark has an extensive background as an Executive and Non-executive Director within the US biotechnology sector and is also a medical oncologist. Mark’s time commitment is one to two days per month.

The Board met regularly throughout the year, either in person or by video conferencing methods, with ad hoc meetings also being held. The role of the Board is to provide leadership of the Company and to set strategic aims but within a framework of prudent and effective controls which enable risk to be managed to acceptable levels. The Board has agreed the Schedule of Matters reserved for its decision, which includes ensuring that the necessary financial and human resources are in place to meet its obligations to its shareholders and others. It also approves acquisitions and disposals of businesses, major capital expenditure, annual financial budgets and recommends interim and final dividends. It receives recommendations from the Audit Committee in relation to the appointment of an auditor, their remuneration and the policy relating to non-audit services. The Board agrees the framework for Executive Directors’ remuneration with the Remuneration Committee and determines fees paid to Non-executive Directors. Given the relative size of the Company, there is currently no separate Nomination Committee and the Board, with advice from the Remuneration Committee, takes responsibility for any recruitment of Executive and Non-executive Directors, together with succession planning. Board papers are circulated before Board meetings in sufficient time to allow meaningful review and preparation by all Board members.

Conflicts of interest

Each Director has a duty to avoid situations in which he or she has or can have a direct or indirect interest that conflicts, or possibly may conflict, with the interests of the Group. The Board requires each Director to declare to the Board the nature and extent of any direct or indirect interest in a proposed transaction or arrangement with the Group and the Company Secretary maintains a register of Directors’ other interests. The Board has power to authorise any potentially conflicting interests that are disclosed by a Director.

Board evaluation and performance

The performance of the Board is evaluated on an ongoing basis informally with reference to all aspects of its operation including, but not limited to: the appropriateness of its skill level; the way its meetings are conducted and administered (including the content of those meetings); the effectiveness of the various Committees; whether corporate governance issues are handled in a satisfactory manner; and whether there is a clear strategy and objectives.

A new Director, on appointment, is briefed on the activities of the Company. Professional induction training is also given as appropriate. The Chairman briefs Non-executive Directors on issues arising at Board meetings if required and Non-executive Directors have access to the Chairman at any time. Ongoing training is provided as needed. Directors are continually updated on the Group’s business by means of Board presentations on risk and compliance matters as well as issues covering pensions, social, ethical, environmental and health and safety.

In the furtherance of their duties or in relation to acts carried out by the Board or the Company, each Director has been informed that they are entitled to seek independent professional advice at the expense of the Company. The Company maintains appropriate cover under a Directors and Officers insurance policy in the event of legal action being taken against any Director.

Each Director is appraised through the normal appraisal process. The Chief Executive is appraised by the Chairman, the executive Board members by the Chief Executive and the non-executive Board members by the Chairman. Each Director has access to the services of the Company Secretary if required.

The Non-executive Directors are considered by the Board to be independent of management and are free to exercise independence of judgement. The Non-executive Directors have never been employees of the Company nor do they participate in any of the Company’s pension schemes or bonus arrangements. They receive no remuneration from the Company other than the Directors’ fees. Dr Eliot Forster, shortly after his appointment to the Board in 2018, received an award of share options, which were equivalent to one year’s fee for his services as Chairman. The share options which are now fully vested do not carry any performance obligations (further details are provided within the Remuneration Report). The Board and Company’s advisers do not consider the share options, given their relatively low value in relation to Dr Forster’s fee for his services and his income from other roles outside of the Avacta Group, to impact his independence.

Directors are subject to re-election at the Annual General Meeting following their appointment. In addition, at each Annual General Meeting one third (or whole number more than one third) of the Directors will retire by rotation.

As the Group evolves and develops, the composition of the Board will change to reflect the priorities of the Group. There are currently no ethnic minority Board members; however, the Group is satisfied that as further Directors are added to the Board that there will be no limitation of opportunities due to diversity.

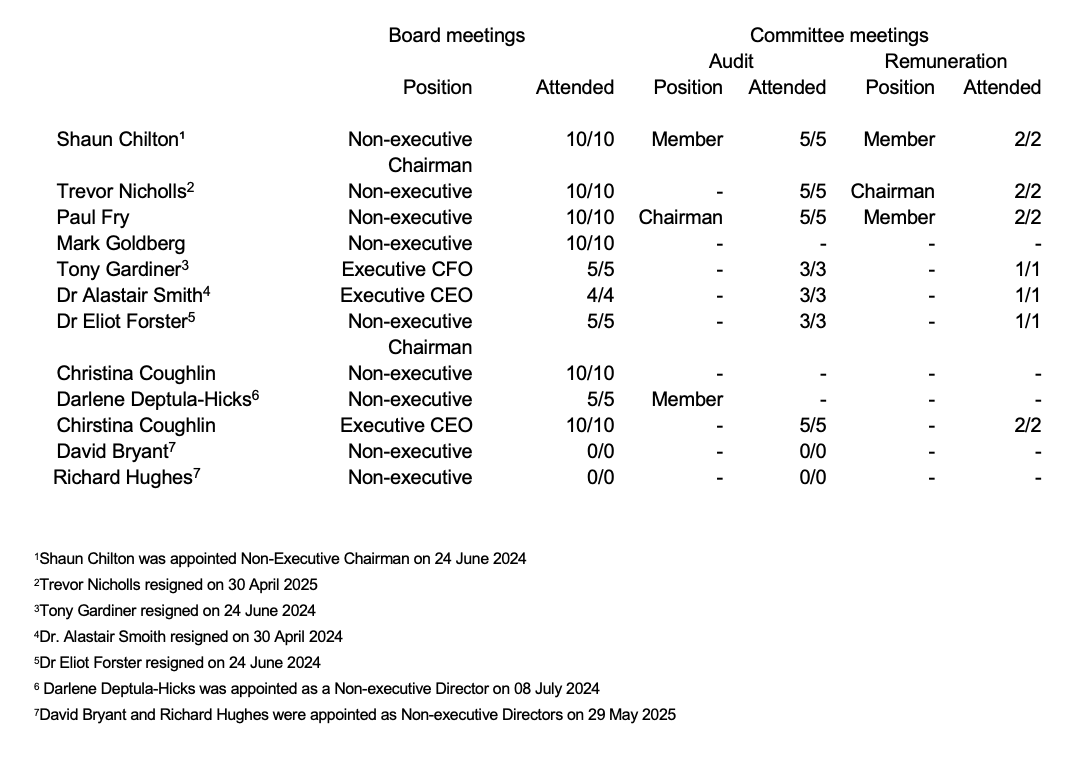

The table below shows the number of Board meetings and Committee meetings held during the period and the attendance of each Director:

Audit Committee

The Audit Committee (‘the Committee’) is established by and is responsible to the Board.

Paul Fry is the Chair of the Committee and is considered to be an independent Non-executive Director. Paul is a member of the Chartered Institute of Management Accountants and brings significant breadth of recent and relevant financial experience to his role, including roles as Chief Financial Officer of Argenta and as Chief Financial Officer of Vectura Group Ltd, which was listed on the Main Market of the London Stock Exchange until it was acquired by Philip Morris International Inc. and subsequently de-listed in October 2021. Paul has recently been appointed as Chief Financial Officer at Oxford Instruments Plc. The current other member of the Committee is Shaun Chilton, who is a Non-executive Director and has gained wide experience in regulatory, commercial and risk issues.

The terms of reference of the Audit Committee include the following responsibilities:

- To monitor and be satisfied with the truth and fairness of the Company’s financial statements before submission to the Board for approval, ensuring their compliance with the appropriate accounting standards, the law and the Listing Rules of the Financial Services Authority

- To monitor and review the effectiveness of the Company’s system of internal control

- To make recommendations to the Board in relation to the appointment of the external auditor and their remuneration, following appointment by the shareholders in the Annual General Meeting, and to review and be satisfied with the auditor’s independence, objectivity and effectiveness on an ongoing basis

- To implement the policy relating to any non-audit services performed by the external auditor

Risk management

The Board is responsible for risk management and reviewing the internal controls systems. The internal control systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable, and not absolute assurance against material misstatement or loss. Given the relative size of the Group, there is not currently a separate internal audit function.

The Group highlights potential financial and non-financial risks which may impact on the business as part of the risk management procedures in the form of a Risk Register. The Board receives these reports periodically and monitors the position at Board meetings. There are ongoing processes for identifying, evaluating and mitigating the significant risks faced by the Group, which are reviewed on a periodic basis. The review process involves a review of each area of the business to identify material risks and the controls in place to manage these risks given the production, regulatory and supply chain considerations within the Diagnostics Division and the commencement of the first clinical trials in the Therapeutics Division. The process is undertaken by the Chief Financial Officer and senior managers with responsibility for specific controls. Where any significant weakness or failing is identified, implementation of appropriate remedial action is completed following approval by the Board.

The Group maintains appropriate insurance cover in respect of actions taken against the Directors because of their roles, as well as against material loss or claims against the Group. The insured values and type of cover are comprehensively reviewed on a periodic basis.

Remuneration Committee

The Remuneration Committee is chaired by Mark Goldberg (effective May 2025) and the other current members of the Committee are Shaun Chilton and Paul Fry, all of whom are Non-executive Directors. The Committee meets at least once a year with the Chief Executive and Chief Financial Officer in attendance as appropriate.

The terms of reference of the Remuneration Committee include the following responsibilities: To determine the framework and policy, together with the individual packages of the remuneration of the Executive Directors and certain other senior executives of the GroupTo determine targets for performance-related pay schemesTo review employee benefit structuresTo produce an annual report of the Committee’s remuneration policy

Shareholder communications and engagement

Responsibility for investor relations sits with the Chief Executive Officer, supported by the Chief Financial Officer and Group Communications Director together with input from other members of the Senior Management Team as required.

The Company is committed to communicating openly with its shareholders to ensure that its strategy and performance are clearly understood. We communicate with shareholders through the Annual Report & Accounts, full-year and half-year announcements, trading updates and the Annual General Meeting, and we encourage shareholders’ participation using technology platforms such as the Investor Meet Company platform.

A range of corporate information (including the Annual Report & Accounts) is also available to shareholders, investors and the public on our website, www.avacta.com. The Company uses intermediaries such as Investor Meet Company and Vox Markets to ensure that key updates provided via RNS releases are relayed to as many shareholders as possible. The Directors encourage the participation of all shareholders, including private investors, at the Annual General Meeting, with over 100 shareholders attending the 2024 AGM in person.

The Chief Executive Officer and Chief Financial Officer meet regularly with institutional shareholders to foster a mutual understanding of objectives and communicate back to the Board. The Chairman and Non-executive Directors are also available to discuss governance and other matters directly with major shareholders.

The Company also holds science days, where investors and significant private shareholders are provided with an update on the Group’s scientific activities by members of the Board and Senior Management Team.

Share dealing code

The Company has adopted a code on dealings in relation to the securities of the Group. The Company requires the Directors and other relevant employees of the Group to comply with the Share Dealing Code and takes proper and reasonable steps to secure their compliance.

Corporate social responsibility

The Board recognises the importance of corporate social responsibility and seek to take account of all of the interests of the Group stakeholders, including shareholders, partners, employees, customers and suppliers. The Board wants to establish and maintain an environment in which employees, suppliers and partners act in an ethical and socially responsible way in operating the business and the impact of its activities relating to health, safety and environmental issues.

Employee welfare and engagement

It is the Group’s policy to involve employees in its progress, development and performance. The Executive Directors regularly engage with employees, most of whom are either shareholders or holders of share options, to seek their views and provide briefings and presentations on key developments and strategy. The updates also follow key events within the financial reporting calendar and aim to give staff the same level of insight provided to institutional shareholders and analysts, providing details of the business objectives, strategy and business model, together with sharing of technical progress across the various teams within the Group. Senior management work across all the Group’s facilities and actively seek regular feedback from staff to ensure that the strategy and aims of the Group are readily understood.

Training, career development and promotion of disabled persons

Applications for employment by disabled persons are fully considered, bearing in mind the respective aptitudes and abilities of the applicants concerned. It is the policy of the Group that the training, career development and promotion of a disabled person should, as far as possible, be identical to that of a person who is fortunate enough not to suffer from a disability. In the event of members of staff becoming disabled, every effort is made to ensure that their employment with the Group continues.

Equal opportunities and diversity

The Group is a committed equal opportunities employer, and its employees and job applicants will receive equal treatment regardless of age, disability, gender reassignment, marital or civil partner status, pregnancy or maternity, race, colour, nationality, ethnic or national origin, religion or belief, sex or sexual orientation.

The Group does not have formal diversity quotas but recognises that a diverse employee profile is fundamental to the business. The gender profile across all employees as at 31 December 2024 was 52% female and 48% male.

Health and safety

The Group has well-defined health and safety policies and procedures, complying with current legislation and safeguarding staff, contractors and visitors. Christina Coughlin is the Executive Director responsible for health and safety, chairing Group meetings and reporting on health and safety matters to the Board. The Group’s policies and procedures form a part of staff induction and training programmes. Regular internal safety audits are carried out and no significant issues have been identified by these audits.

Ethics and compliance

The Group’s Diagnostics and Therapeutics Divisions operate around product development, drug development and clinical trials where there are highly regulated ethical frameworks in place.

Political and charitable donations

The Group does not make political or charitable donations, although charitable fundraising by employees is encouraged.

Modern slavery and human trafficking statement

The Group ensures that all employees are eligible to work in their country of employment. The majority of our workforce are employed directly; however, where agency workers are utilised, it is ensured that these same checks are performed by the supplier.

The Group has a Whistleblowing Policy, where anyone who raise concerns through a defined process, are protected. In addition, there are robust policies in place that ensure equality amongst colleagues, as well as deploying a zero-tolerance approach to harassment and bullying in all areas of the business.

Environment and greenhouse gas emissions

Due to the nature of the Group’s divisions, it has a low environmental impact, and seeks to minimise any environmental impact of its operations and complies with relevant regulations and legislation.

Work started during the period to develop the processes to measure and report on the Group’s Scope 1 and Scope 2 GHG emissions. This will allow the Group to better identify areas of focus in minimising the impact of its operations, as well as setting effective targets, and these will be refined over future periods.

In the table below:

- Scope 1 emissions cover direct emissions of greenhouse gas from fuel combustion

- Scope 2 emissions cover emissions from purchased electricity

- Scope 3 emissions cover all other indirect emissions that occur in a company’s value chain. They are not included in the reporting below but the Group will continue to develop its processes to allow measurement and reporting on these emissions in future periods.

|

2024 GHG Emissions (CO2e metric tons) |

2023 GHG Emissions (CO2e metric tons) |

|

|

Scope 1 |

213 |

210 |

|

Scope 2 |

110 |

109 |

|

Total1 |

323 |

319 |

The increase in Scope 1 CO2e metric tons in 2024 is largely attributable to the inclusion of a full year of emissions data relating to Coris, compared with a shorter seven month period post-acquisition in 2023. These emissions are predominantly driven by car fleets of sales representatives and field service engineers.

The increase in Scope 2 CO2e metric tons in 2024 is again attributable to the inclusion of a full year of emissions data for Coris.

In addition, the 2024 emissions data also includes reporting for Coris Bioconcept SRL since its acquisition date. Coris installed solar panels at their premises in Gembloux, Belgium to help minimise non-renewable energy usage.

This report was approved by the Board of Directors and authorised for issue on 06 June 2025 and was signed on its behalf by:

Shaun Chilton

Chairman

05 June 2025